Tutorial — Part 3

« Back to Part 2 | Continue to Part 4 »

Step #2: Enter transaction data (Continued)

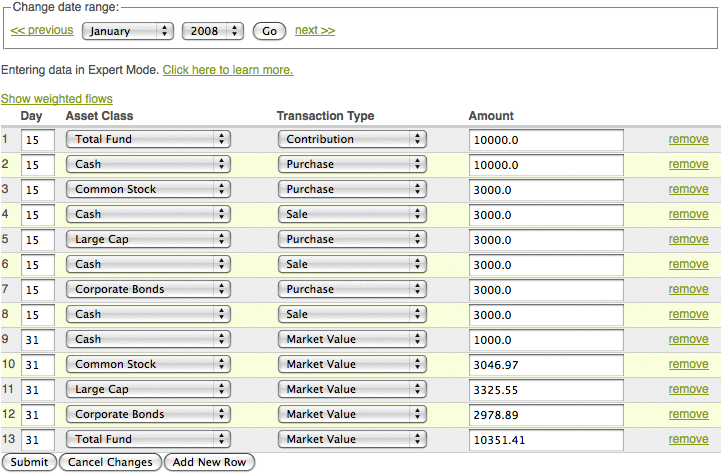

In this example, all the transactions for January 2008 have been entered. Click 'next >>' under 'Change date range' to proceed to February.

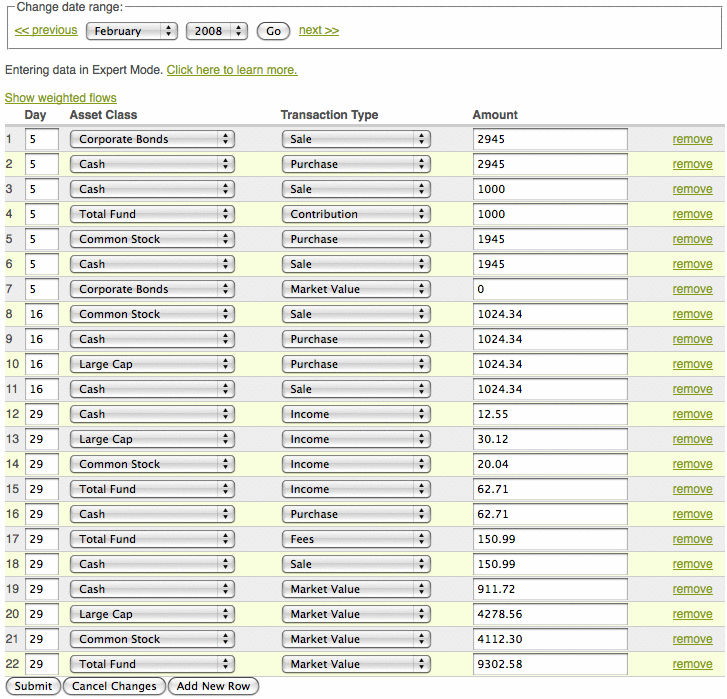

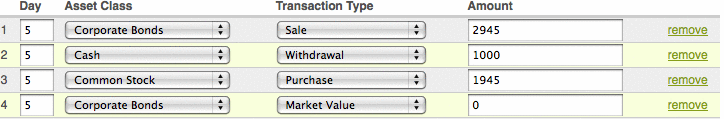

Consider the following scenario: on the 5th of February, you decide to sell all your Corporate Bonds investments, purchase additional Common Stock investments, and withdraw $1,000 of cash from the account. Let us assume the sale price of the Corporate Bonds asset class was $2,945.00. These transactions would be entered as follows:

To break this down: first, $2,945.00 of Corporate Bonds assets are sold. Since these transactions are entered in simple mode, this money is automatically added to cash. $1,000.00 is then withdrawn from cash. In simple mode, all cash withdrawals are deduced from the cash asset class. The remaining $1,945.00 is used to buy Common Stock assets. Finally, it is necessary to enter a market value of $0 for the Corporate Bonds asset class to show that all the funds were removed from the asset class on this day.

TIP: Typically, it is not necessary to specify the market values for every day a purchase or sale occurs. However, when selling all the investments of an asset class, it is best to enter a $0 market value to specify that this asset class is closed as of the transaction date.

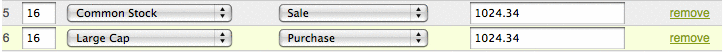

Let us now assume that on the 16th of February, you decide to sell $1,024.34 of Common Stock and use the proceeds of this sale to purchase an equivalent amount of Large Cap. These are the transactions to enter:

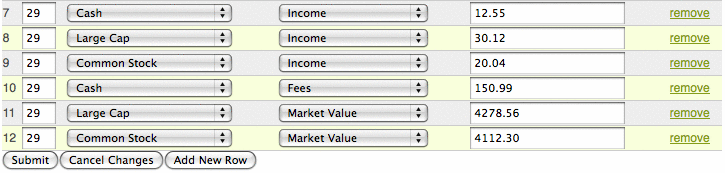

For this account, income, fees, and market values are entered on the last day of the month. In simple mode, fees are always deducted from cash. Enter these transactions as follows:

Click 'Submit' to save the data.

TIP: FreePerformanceReport.com does not assume that dividends are automatically reinvested. If your dividends are reinvested, you must enter an income and a purchase transaction on the date the dividend pay date. In simple mode, all income proceeds are automatically credited to cash.

Addendum: Expert mode

In expert mode, the transactions required for this scenario are listed below. For the most part the report generated for simple mode and expert mode here be identical, with the exception of the total fund market value on 2/5. The simple mode version, which calculates total fund on the fly, takes the market value of the Corporate Bonds asset class into account when calculating Total Fund for that date. In the expert mode version, we did not specify a Total Fund market value on that date, so the return is assumed linear from 1/31 through 2/29. Of course a Total Fund market value could be specified for that date if the data were at hand.